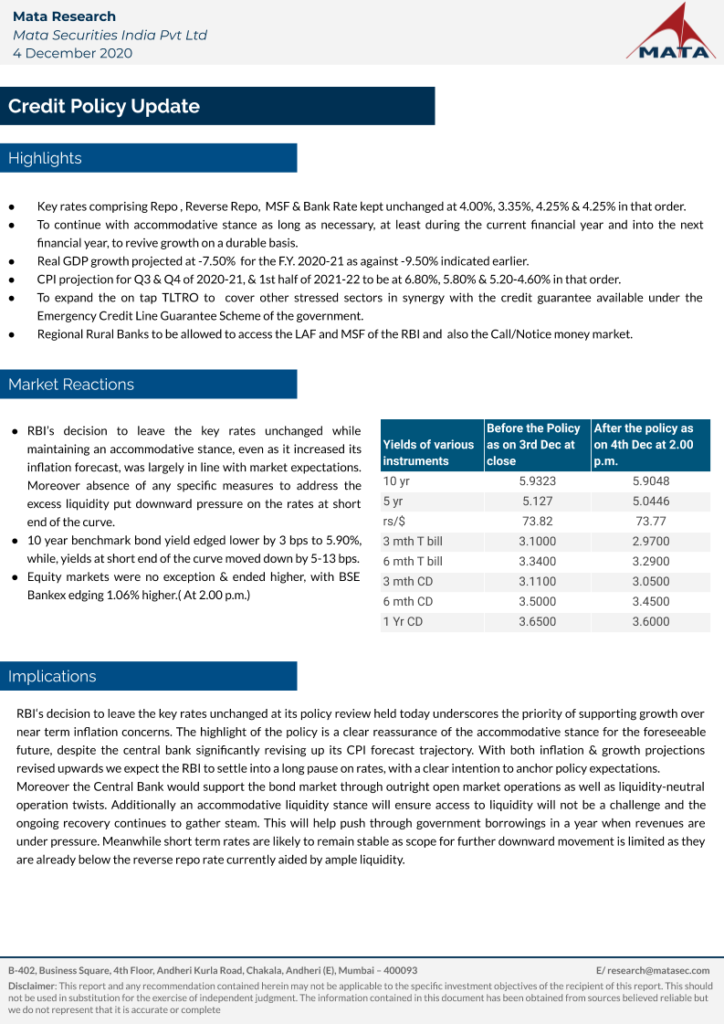

The MPC of the Reserve Bank of India unanimously voted to keep the key rates unchanged and maintained an accommodative stance amid elevated inflation constraints. Find below the key highlights and implications of the policy on 4th December 2020.

The MPC of the Reserve Bank of India unanimously voted to keep the key rates unchanged and maintained an accommodative stance amid elevated inflation constraints. Find below the key highlights and implications of the policy on 4th December 2020.

RBI’s Monetary Policy Committee has kept Repo Rate unchanged at 4% amid rising inflationary pressure and a grim economic outlook. Here are the highlights and implications of the Credit Policy.

The government on Friday evening steeply revised upwards its 2020-21 borrowing programme by 53.85% to Rs 12 lakh crore. It was earlier estimated to be Rs 7.8 lakh crore, indicating that the Centre is giving shape to an imminent and sizeable fiscal package to arrest the COVID-19 related slowdown.

The above revision in borrowings has been necessitated on account of the COVID-19 pandemic.

Here is our take on the revised borrowings and what RBI can do next…